PRECIOUS METALS IN THE FORM OF JEWELLERY, COINS AND BARS

5 Reasons to invest in precious metals in the form of jewellery and accessories

Physical precious metals are a timeless asset that will always have a value that lasts the test of time to provide the ultimate insurance for your wealth against any future financial crisis. Spreading your investment across property, stocks, crypto, and precious metals is a wise approach to minimise risk to manage your portfolio. In the case that stocks or property are underperforming, the probability of the Gold price will over-perform.

In western countries, gold jewellery and accessories are not considered a monetary investment, because the principles guiding big brands are consolidating to maximisation of gross margins. For this reason, most people only buy Gold bars or Gold coins as an investment. If you decide you want to know more, check out our website www.rubyta.com to know how you can get started owning investing in precious metals as tangible assets in the form of jewellery and accessories. To help you get a better understanding of this matter, here are the top five reasons why you should invest in precious metals in the form of jewellery and accessories:

1. A liquid asset

Bullion in form of jewellery and accessories as a fashion statement and an asset that can easily be converted into cash in a short amount of time, with Elegant pieces and timeless style are generally won’t out of trend. For any piece of Fine Jewellery, the material will be durable and long-lasting, as long it’s taken care of. Everyday jewellery, often a minimalist has the potential to last a lifetime, and their wearability certainly makes up for the cost per wear.

“Diversifying Well Is The Most Important Thing You Need To Do In Order To Invest Well”, –

2. Portfolio Diversification

Diversification is an intelligent strategy to mitigate risk and maximise returns by allocating investments funds across various financial instruments or industries. Putting min 5 – 10% of your liquid wealth into physical precious metals is the best way of hedging your other investments. Precious metals are used as a financial backing for currency and often held in the form of Gold bars, also known as “gold bullion”. Many governments hold investments in Gold in the convenient form of bullion. Historically Gold has had an opposite correlation to stocks and other financial forms of investment. A properly diversified portfolio that combines Gold with bonds and stocks in order to reduce the overall volatility and risk of the portfolio.

3. A Tangible Asset

Fine Jewellery and accessories have portability, so they can easily be moved or stored, this makes them excellent items to store value considering how efficient to have the item compressed into something quite small. For example, some pieces of jewelry may be valued at the same price as a car or a house.

Precious metals are an investment well worth considering, increase in value over time, and have served as a hedge against inflation and the currency crisis. Although the price of Precious metals can be volatile in the short term, it has always maintained its value over the long term. Storing precious metals bullion is still one of the best ways to maintain or increase your wealth.

4. Heirlooms Pieces

People use precious metals as a way to increase and pass on their wealth from one generation to another as heirlooms pieces. Gold has maintained its value over the ages, unlike paper currency. Precious Metals promises quality, longevity, preciousness, and fashioned it into a piece of jewellery, worn it as a symbol of status or power, or given Gold jewellery as a public declaration or handed it down through countless generations.

5. Increasing Demand and Scarcity

According to Grandview Research in 2019, Gold is the most common precious metal used for making jewellery around the world and held the largest market share that was valued at USD 117.1 billion in 2018 due to an increase in exports and imports. Most of the Gold on sale in the market comes from the sale of Gold bullion from the vaults of the world’s central banks.

Increased wealth in China’s emerging market economies boosts the demand for Gold as well, where Gold is a traditional form of saving, sees a constant demand for Gold. India is the second-largest Gold-consuming nation in the world; it has many uses there, including jewellery. As such, the Indian wedding season in October is traditionally the time of the year that sees the highest global demand for Gold.

Because Gold is highly valued and in very limited supply, it has long been used as a medium of exchange or money. Other things need to consider about:

- Precious metals are a Tangible Asset

- Precious metals Have No Counterparty Risk. …

- Precious metals ownership can be Private and Confidential. …

- Precious metals are Money, Liquid and Portable asset

Shop with Rubyta

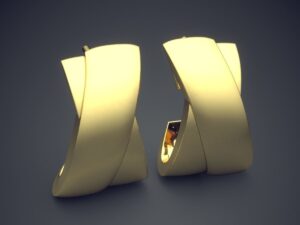

X Shape Earrings

€

Facet Cuban Ring

€

Simple Cufflinks

€

Infinity Knot Ring

€226.46

JOIN RUBYTA

Join Rubyta today and experience bullion in the form of jewellery and accessories. By signing-up, you may be the first to know about exciting new designs, special events, store openings and much more.